An approach that is designed to inspire you to lead a fulfilled life.

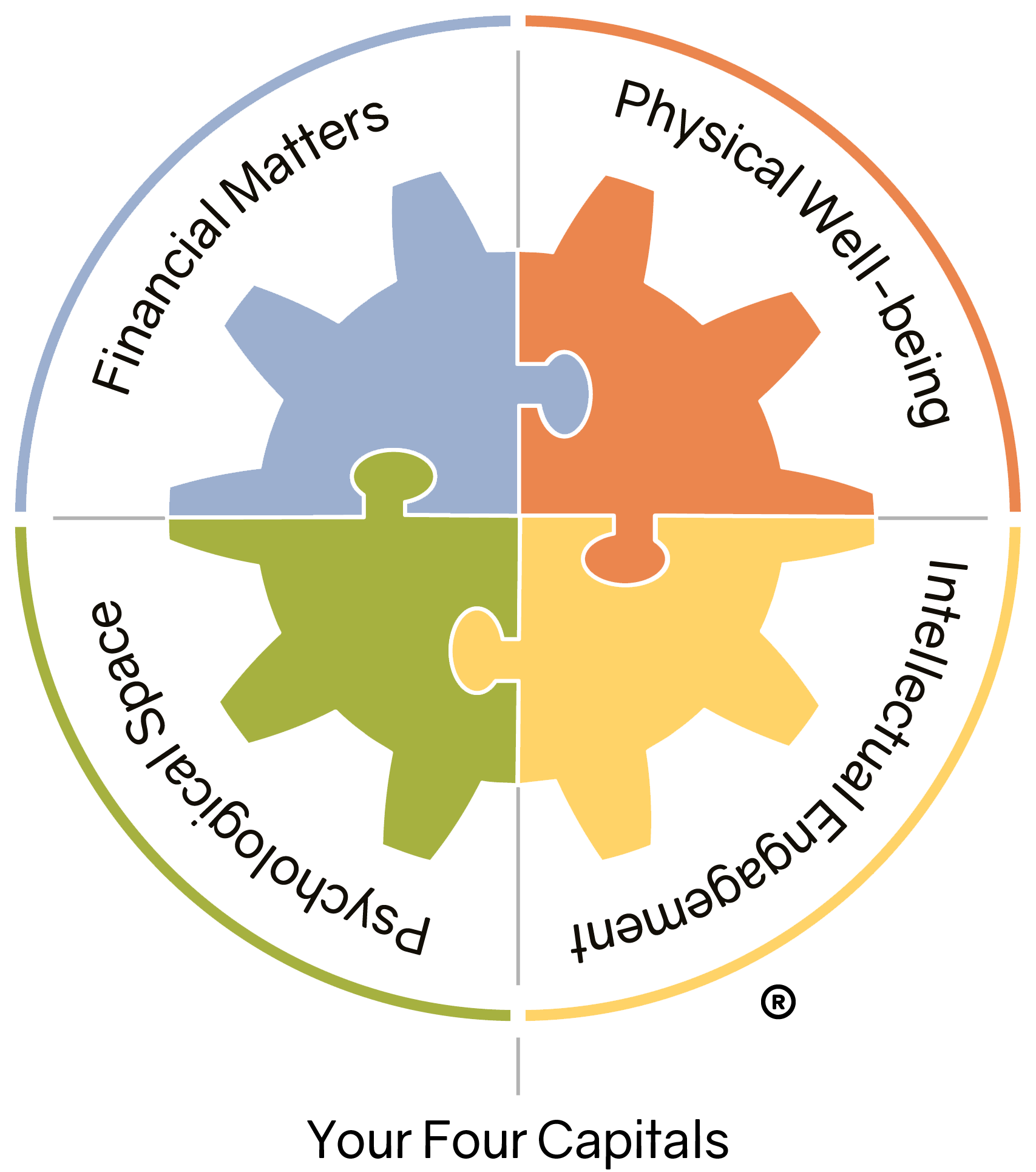

Since 1982 we have approached wealth management differently by focusing on our clients’ Four Capitals. The Four Capital approach is based on objective, goal-based advice. Simply put we are all artisans of our own lives, each pursuing our own craft, constantly striving to get more from life, to live in a balanced state. Our team works with you to build your wealth across Four Capitals – Financial Matters, Physical Well-being, Intellectual Engagement, and Psychological Space.

We believe art is about how it makes you feel and the meaning it carries – not the physical canvas or block of clay. It’s what an artist does with these materials. An artist starts with a vision and creates a work of art – very much like your accumulation of wealth. Think of your Four Capitals as a work of art – you define what each capital means to you and what you want to do with them. We are here to guide you in your pursuit and practice of all Four Capitals.

Not all services will be appropriate or necessary for all clients, and the potential value and benefit of Schultz Financial Group’s (“SFG’s”) services will vary based upon a variety of factors, such as the client’s investment and financial circumstances, the client’s tax bracket, the nature and amount of the client’s employer and outside benefits, the client’s level of cooperation and communication, and the client’s overall objectives. The effectiveness and potential success of a financial plan depends on a variety of factors, including but not limited to the manner and timing of implementation, coordination with the client and the client’s other engaged professionals, and market conditions. Statements regarding the clients served by the firm are not indicative of any client experience or level of satisfaction in working with SFG. Adherence to our fiduciary duty is not a guarantee of client satisfaction or any particular outcome. A financial adviser’s compensation structure should not be viewed as the sole determining factor in obtaining or retaining their services. The receipt of personalized and tailored services, or the client’s access to financial or professional resources should not be construed as a guarantee of a particular outcome. All investing comes with risk, including risk of loss.