Shifting Financial Leverage Poses Economic Risk

We believe the 2008 financial crisis was caused by too much leverage, specifically in the financial sector. The average total debt held by S&P Financials was approximately six times their equity1. In the US today, banks have done their part in deleveraging and this ratio is now approximately one for one1. The Federal Reserve’s response to the crisis was to lower rates to essentially zero to encourage spending and borrowing to stimulate the economy. Both businesses and the government seem to have quickly seized the opportunities created by cheap debt.

Increasing Debt in Small Cap Companies

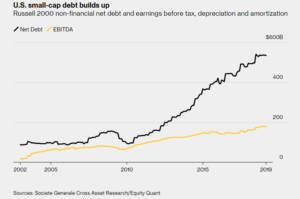

Companies within the Russell 2000 index, an index made from small cap companies, have seen a significant buildup in the amount of debt they have accumulated since the financial crisis1. The following graph shows the significant increase in debt, and the poorly correlated increase in EBITDA (earnings before interest, tax, depreciation and amortization):

Business Credit Ratings Decreasing

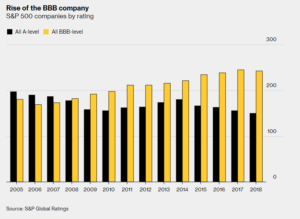

The ability to borrow extreme sums of money at very low interest rates keeps the financial burden of repaying those sums low (however, the risk then becomes refinancing that debt if interest rates rise). This low financial burden has allowed companies to move up in the credit rating into the BBB space, which now accounts for more than all A-rated debt1. Additionally, previously A-rated companies have also taken advantage of the low interest rate environment and taken on significant sums of debt causing a deterioration of their financial ratios, thus incurring a downgrade into the BBB space. Having a BBB rating is the last level of investment grade debt. Any lower of a rating and it becomes classified as “junk”. Here is a graph showcasing the rise in BBB rated companies:

Low-Interest Rates Enable Government to Afford Interest on Deficit

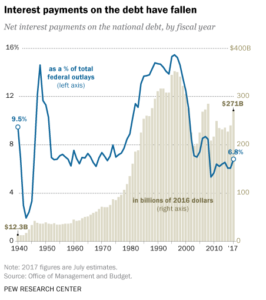

Just as companies have seized this opportunity to take advantage of “easy money”, or low interest rate monetary policy, the government has also participated. Deficit spending in 2018 hit $779 billion dollars, and is on pace to hit $1 trillion next year2. The graph below illustrates the interest payments made on the national debt dating back to the 1940s:

The total amount of US national debt now sits at $22 trillion2. However, because interest rates have been so low for so long, the burden of that debt is similar to the burden experienced in the early 70s, even though the dollar amount of debt is substantially higher. If the Fed decides to raise rates, the burden will be felt by both corporations and the government, as more and more resources must go into servicing these debt payments.

Bloomberg has written an article about how this shift in leverage has been made over the last decade. It discusses how corporate borrowing has soared and quality has fallen. It also outlays what Europe has done, or rather hasn’t done, in terms of reducing their leverage. Additionally, they also discuss what China has been up to and question if their expansive growth in borrowing is sustainable. To read that article, click here.

Source:

Important Disclosure Information: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Schultz Financial Group Incorporated. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Schultz Financial Group Incorporated is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Schultz Financial Group Incorporated’s current written disclosure statement discussing our advisory services and fees is available for review upon request. Please Note: Schultz Financial Group Incorporated does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Schultz Financial Group Incorporated’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Design by Social Firm | Design by Refresh Design Services | Copyright © 2019 Schultz Financial Group Inc.

Design by Social Firm

Design by Refresh Design Services

Copyright © 2019 Schultz Financial Group Inc.