China’s Municipal Debt Challenge

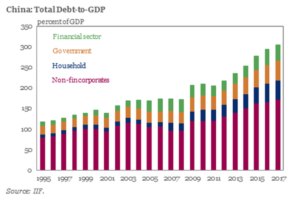

As we have discussed in our other blog topics focused on China, the GDP numbers, total outstanding debt, and other various statistics reported by their government have been questioned and scrutinized over the years. While most analysts put China’s debt/GDP near 250%, The Institute of International Finance (IIF) actually believes that China’s debt load was possibly as high as 300% in 2017. Today, we expect that to be much higher.

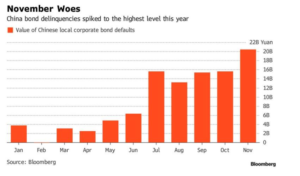

According to an S&P credit analyst, “the potential amount of debt is an iceberg with titanic credit risks,” regarding the amount of debt held by municipalities in China1. As shadow banking in China has grown in complexity and size, so has local government debt1. Because of China’s recent slowdown in growth and spiking Chinese bond delinquencies, Beijing has been adding pressure on local municipalities to become much more transparent with their debt. Below is a chart that shows how much Chinese local corporate bond defaults rose in 2018:

Probes investigating how much local debt exists in China have shown that off-book borrowing exceeds on-book borrowing in some places, according to Bloomberg2. According to a Chinese economist, “the problem can’t be delayed anymore,” meaning fiscal revenues and GDP growth aren’t enough to cover the interest and principal payment amounts1. This further calls into question the GDP rate the Chinese government publishes, because a growing economy of 6% GDP would not have declining tax revenue. We believe the efforts to deleverage local governments remain precarious as the government has recently pledged to cut taxes, which further reduces the ability to repay their debt load.

With low-interest rates being embraced by central banks across the globe, China has been able to take advantage of this type of environment. For example, the China Development Bank was able to recently sell a 270-day bond with a coupon of 4.8%1. To put this into context, it sold a similar bond in January of this year for 6.3%1. A compression of 150 basis points over a couple of months speaks to the credit mania being experienced around the world.

China’s financial sector is approaching twice the size of the US, and its economy is years behind in terms of size1. With shadow banking and financial complexity growing in China, “the bigger worry is the moral hazard issue,” according to Zhu Ning, professor of finance at Tsinghua University1. As with any debt issue, regardless of the country, the three ways out are default, inflation, or growth. With the amount of growth in China being questioned, and the extreme ramifications of a default situation, inflation could be the response of the Chinese government.

Sources:

Important Disclosure Information: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Schultz Financial Group Incorporated. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Schultz Financial Group Incorporated is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Schultz Financial Group Incorporated’s current written disclosure statement discussing our advisory services and fees is available for review upon request. Please Note: Schultz Financial Group Incorporated does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Schultz Financial Group Incorporated’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Design by Social Firm | Design by Refresh Design Services | Copyright © 2019 Schultz Financial Group Inc.

Design by Social Firm

Design by Refresh Design Services

Copyright © 2019 Schultz Financial Group Inc.