Executive Summary

It seems that no matter what you hear or read, outlooks for the global and U.S. economy hinge on the path COVID-19 takes moving forward. With that path currently unknown, the future remains shrouded in a dense fog.

At SFG, we are not in the business of guessing uncertain outcomes or timing unpredictable markets. Instead, we believe the best tools for navigating today’s environment are risk mitigation and scenario planning. By identifying various downside scenarios investors may face in the future, we can actively work to help mitigate those risks without knowing which scenarios will actually occur or when they will arrive. The goal is to put our clients in the best position to take advantage of any potential opportunities that may arise when the fog lifts and economic outlooks become clearer.

2020 Overview

The stock market does not equal the economy. While the pandemic disrupted the U.S economy throughout 2020, the story was different for stocks. After an initial selloff, stocks in general quickly recovered once the Federal Reserve stepped in with liquidity and stimulus for U.S. markets and businesses. The federal government provided support to consumers through their stimulus programs. Buoyed by rate cuts, bailouts, and stimulus checks, investor sentiment was funneled into the market’s growth sectors, with tech being among the best performers for the year.

As investors sought a safe haven from the sell-off in early 2020, interest rates plummeted and the 10-year Treasury yield hit all-time lows.1 With the current Federal Funds rate at 0.25%2, borrowers have taken to the housing market. However, while demand reached its highest level since 20063, housing supply has fallen to record lows.

With many Americans now working from home, consumption preferences are changing rapidly. For example, online grocery sales – one of the last untapped markets in the e-commerce world ‒ are expected to have grown nearly 40% in 2020.4 While we expect growth to normalize after the pandemic, we believe some aspects of this consumption change will continue into the future.

Which Monetary Policy Road Are We On?

With inflation a major topic of discussion, let’s explore two roads for monetary policy along with their inflation implications.

Road 1: Monetarism

Monetarism was the road we traveled when SFG started back in 1982. Monetarism’s equation is MV=PQ, known as the Quantity Theory of Money.5 M is Money Supply; V is Velocity (number of times per year the average dollar is spent); P is Price Level (cost of goods and services); and Q is the Quantity of those goods and services.6 The equation is thought to work as follows: If V is constant and M is increasing, there must be an increase in either P or Q.7 If the money supply grows no faster than the desired rate of economic growth (Q), then inflation is controlled.8

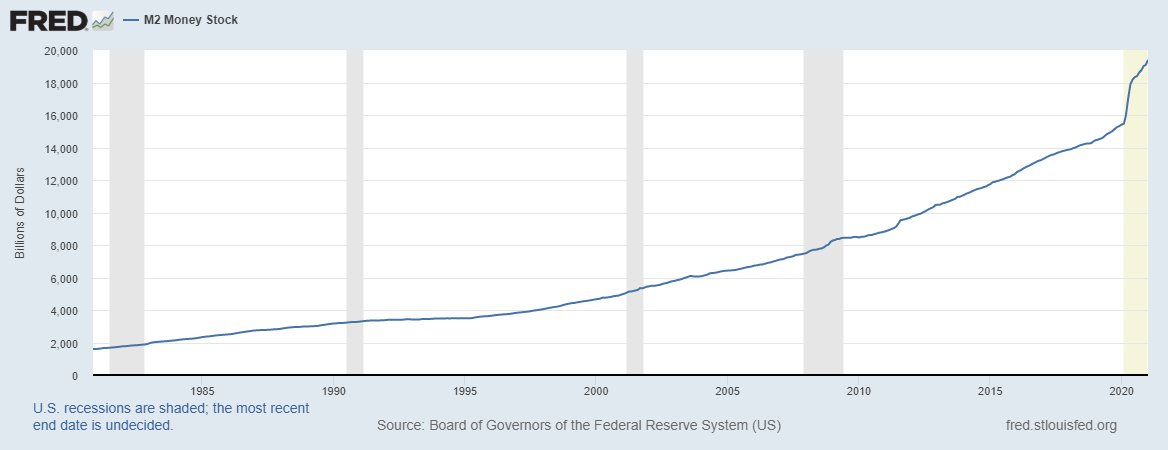

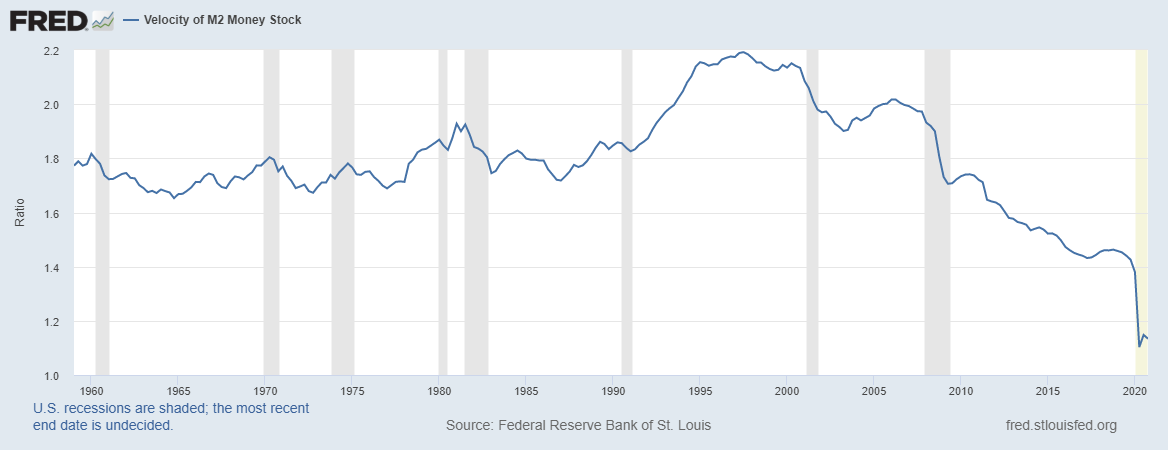

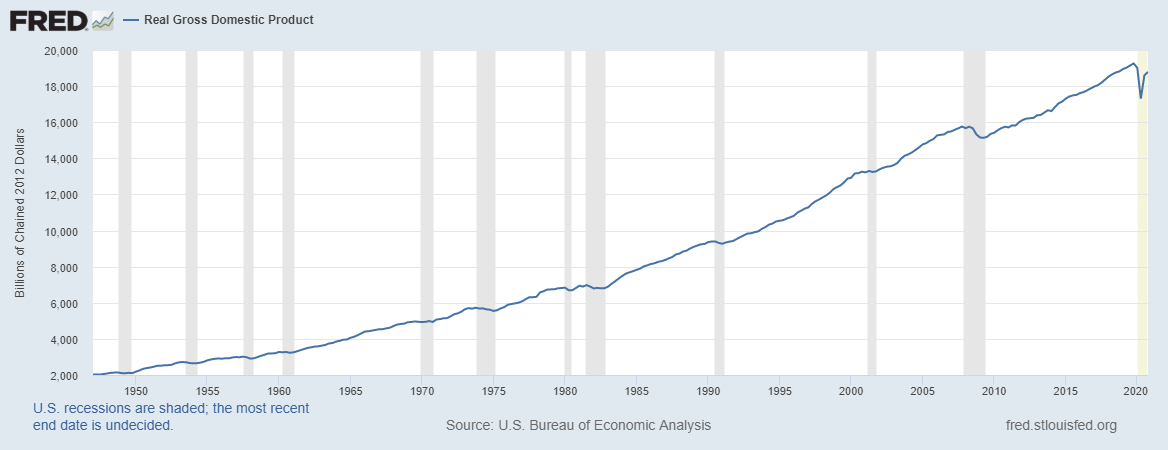

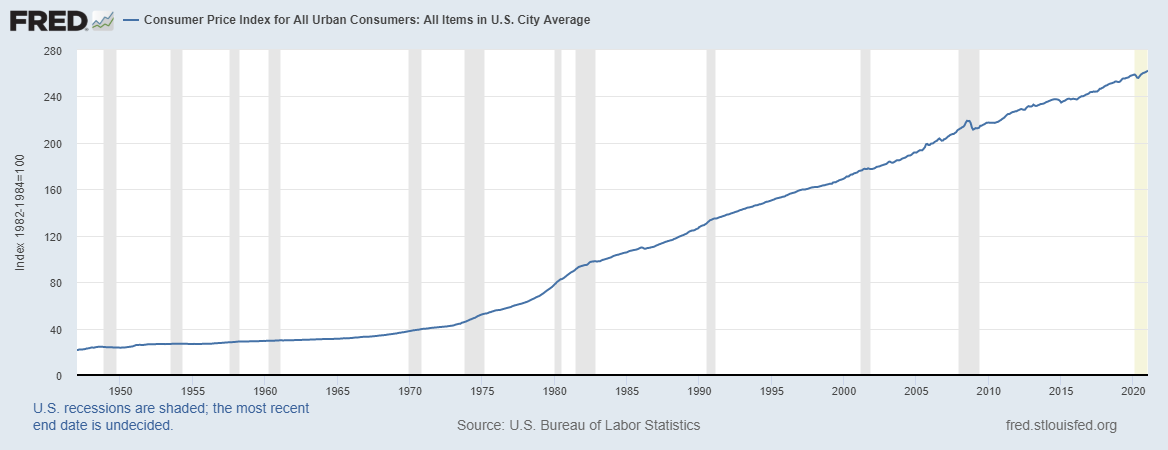

The following charts from the Federal Reserve Bank of St Louis help illustrate Monetarism. As you can see, inflation was low from 2000 to 2020 (Figure 4)9, even though money supply had grown rapidly (Figure 1).10 This was due to velocity declining sharply instead of remaining constant (Figure 2)11, as well as the quantity of goods and services growing at a slow rate (Figure 3).12 Globalization and technology also contributed to keeping price levels down.13

We currently appear to be in a de-globalization and digitalization environment, with artificially low interest rates and a rapidly growing money supply.14 De-globalization could drive prices higher15, but we anticipate digitalization will probably push them lower.16 As velocity stays the same or falls further, inflation will likely remain low.17 The question is whether the dollar will decrease substantially and cause a cyclical increase in inflation above 2%, which would probably not be a secular trend. Also, growing public and private debt tend to suppress GDP growth, as mounting debt has a smaller and smaller stimulative effect on the economy.18 Slower growth, in turn, tends to reduce velocity.19 If the economy generally stays on this road, we would probably not see high inflation until velocity or GDP changes or the digital world does not fully materialize.

Figure 1: Growth in Money Supply

Citation: Board of Governors of the Federal Reserve System (US), M2 Money Stock [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2SL, February 25, 2021.

Figure 2: Velocity of Money Supply

Citation: Federal Reserve Bank of St. Louis, Velocity of M2 Money Stock [M2V], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2V, February 25, 2021.

Figure 3: Real Gross Domestic Product

Citation: U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1, February 25, 2021.

Figure 4: Consumer Price Index (inflation)

Citation: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPIAUCSL, February 25, 2021.

Road 2: Modern Monetary Theory (MMT)

MMT is a non-conforming macroeconomic belief. It theorizes that money supply growth is not constrained because the U.S. is a monetarily sovereign country that can spend, tax, and borrow in their own fiat currency they fully control.20

Simply put, the U.S. government would not rely on taxes or borrowing for spending because it can print as much money as it needs and is the monopoly issuer of the currency.21 The increase in national debt is not a concern to MMT proponents.22

The only concern is inflation.23 As long as enough goods and services can be produced to meet demand, the government can spend what it needs to maintain employment and implement its desired programs.24 The employment piece is a job guarantee program where the federal government provides employment and sets wages.25 This would eliminate unemployment concerns, while a form of taxation could be used to control inflation.26

MMT challenges conventional beliefs, such as the Quantity Theory of Money we discussed in our first road.

Inflation for goods and services has been low, but we have seen substantial asset inflation starting with the tech bubble, followed by the housing/debt bubble.27 Risk has been mispriced and distorted since the Fed moved to a mostly zero interest rate policy after the 2008-09 global financial crisis.28 If we go down the MMT road, it is unknown when inflation will raise its head, how it will be combated and what the outcome will be.29

Looking Ahead to 2021

We believe the disconnect between the stock market and U.S. economy is unlikely to narrow in 2021, as investors continue to grapple with what the landscape will look like beyond COVID-19. As the pandemic persists, we do not expect the Fed to change its monetary policy or Congress to change its fiscal policy while they attempt to keep the economy afloat. Other key areas to watch are corporate bankruptcies, consumer and workplace behavior, and vaccine effectiveness. However, we first must get past COVID-19.

Stock Market

Since January 4, 2021, stocks have continued their torrid ascent, as represented by the S&P 500 gaining 4.25% as of February 8.30 U.S. stock trading volume has followed suit ‒ going from an average daily volume of 7 billion in 2019, to 10.9 billion in 2020, to 14.7 billion in early 2021.31 This is partially attributed to a large increase in new retail investors.32 Between 2010 and 2020, U.S. stock trading volume among retail investors almost doubled to 19.5% of total activity, due to more cost-free trading options and greater access via smartphone apps.33

With more stimulus possibly coming, the Fed continuing to backstop the economy, and the recovery story still intact, some predict another good year for stocks.34 However, investors will likely not see the same performance in 2021 as they did in 2020 to the extent that improving economic data is already priced into the market.35

Fiscal & Monetary Policy

In January, the Federal Open Market Committee stated that “[t]he path of the economy will depend significantly on the course of the virus, including progress on vaccinations.”36 In the meantime, Jerome Powell, Federal Reserve Chairman, continues to reaffirm the Fed’s commitment to maintaining low interest rates and using all available tools until the economy shows significant signs of recovery.37 Additionally, Congress continues to work on drafting a new stimulus bill as we all wait to see what course the virus takes.38

Vaccines

Since the FDA authorized two vaccines for emergency approval, three new strains of COVID-19 have been confirmed, creating some uncertainty about vaccine effectiveness going forward.39 Early indications from Moderna and Pfizer are that their current vaccines protect against the new UK (B.1.1.7) and South Africa (B.1.351) strains.40 However, the full scope of protection is currently unknown. According to Moderna, early research found that its vaccine produced antibodies against the South Africa strain, but levels were six times lower than those produced for other strains.41

Corporate Bankruptcies

COVID-19’s economic impediments took their toll on corporate America in 2020, resulting in 630 bankruptcy filings, the most since 2010.42 However, bankruptcy filings across all chapters were the lowest in 35 years.43 This can be attributed, in part, to institutions being more lenient on deferred/modified payments and $3.1 trillion in aggregate stimulus bills.44 Although the stimulus appears to be working as expected, it may just be prolonging a wave of bankruptcies into 2021 and/or 2022.

Post-COVID Consumer & Business Behavior

One of the biggest questions going forward is: How much of the change in consumer and workplace behavior will be permanent? Forced to adapt to regulatory restrictions put in place during the onset of COVID-19, consumers pivoted to online platforms and businesses. Whenever possible, they also shifted to a work-from-home model in an effort to minimize disruptions to everyday life and slow the spread of the virus.

According to an April 2020 study by McKinsey & Co., a global consulting firm, digital adoption by U.S. consumers accelerated rapidly during the pandemic.45 Hard-hit industries like entertainment, grocery, and apparel saw double-digit increases in first-time users with digital access.46 We witnessed live concerts, blockbuster movies, doctor visits, and grocery shopping move online as e-commerce sales exploded. However, the seismic shift to online platforms has come with some growing pains. For example, the U.S. Postal Service saw package volume increase by roughly 1.2 billion pieces, or 18.8% year-over-year, which the USPS attributes to the “surge in e-commerce.”47

From a business perspective, the shift to work-from-home has largely been successful. A U.S. Census Bureau survey found that roughly 37%48 of employees were working remotely around the end of October 2020, up from an estimated 8.2%49 in February. Further, Gallup data suggest that two-thirds of U.S. employees want to continue working remotely.50

A natural question follows: Have remote workers been as productive from home as they were before the pandemic? The answer is mostly “yes,” according to a PwC survey of 133 executives and 1,200 office workers in November-December 2020.51 The study found that 83% of employers considered the move to remote work to be a success, up 10% from PwC’s survey conducted in June 2020.52 However, only 13% of executives were ready to abandon offices and 87% of employees said an office remains important for team collaboration and relationship building.53

In addition, some executives in the financial sector are finding remote work to be losing its effectiveness and possibly unsustainable over time due to challenges in maintaining culture and collaboration.54 One executive predicted that it is much more likely workers will have hybrid schedules consisting of some days in the office and some at home.55

Going forward, SFG believes that many new work-from-home jobs will be permanent, whether on a full-time basis or as hybrid arrangements. This may result in many U.S. businesses consolidating office space to save on overhead or relocating pricy downtown offices to satellite locations closer to employees.

As always, we will continue to provide updates via SFG Investment Insights as new economic and market information becomes available.

Schultz Financial Group Inc. (SFG) is a wealth management firm located in Reno, NV. Our approach to wealth management is different from many other wealth managers, financial advisors, and financial planners. Our team of fee-only fiduciaries strives to help our clients build their wealth across four capitals: Financial Matters, Physical Well-being, Psychological Space, and Intellectual Engagement. We provide family office and wealth management services to clients located in Nevada, California, and other states. If you’d like more information, please check out our website or reach out to us via our contact page.

[1] https://www.cnbc.com/2020/03/09/10-year-treasury-yield-plunges.html

[2] https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

[4] https://www.supermarketnews.com/online-retail/online-grocery-sales-grow-40-2020

[5 – 8] https://www.investopedia.com/terms/m/monetaristtheory.asp

[9] https://fred.stlouisfed.org/series/CPIAUCSL

[10] https://fred.stlouisfed.org/series/M2

[11] https://fred.stlouisfed.org/series/M2V

[12] https://fred.stlouisfed.org/series/GDPC1

[13] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6472747/

[14] https://www.oecd.org/iaos2018/programme/IAOS-OECD2018_Elkjaer-Damgaard.pdf

[15] https://www.theguardian.com/business/2020/jun/04/deglobalisation-will-hurt-growth-everywhere

[16] https://www.imf.org/~/media/Files/Publications/WP/2019/wpiea2019271-print-pdf.ashx

[18] https://carnegieendowment.org/chinafinancialmarkets/78304

[20-26] https://www.cato.org/sites/cato.org/files/2019-09/cj-v39n3-4.pdf

[28] https://www.dallasfed.org/news/speeches/kaplan/2020/rsk200929

[29] https://www.cato.org/sites/cato.org/files/2019-09/cj-v39n3-4.pdf

[30] https://www.marketwatch.com/investing/index/spx

[33] https://www.wsj.com/articles/individual-investor-boom-reshapes-u-s-stock-market-11598866200

[36] https://www.federalreserve.gov/newsevents/pressreleases/monetary20200729a.htm

[37] https://www.cnn.com/2021/01/27/economy/federal-reserve-jerome-powell/index.html

[49] BICK, A., A. BLANDIN, AND K. MERTENS (2020): “Work from Home After the COVID-19 Outbreak,” Working Paper 2017, Federal Reserve Bank of Dallas.

[51-53] https://www.pwc.com/us/en/library/covid-19/us-remote-work-survey.html

DISCLOSURES: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Past performance is no guarantee of future results. Different types of investments and strategies involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated (“SFG”), or any non-investment related content made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level, be suitable for your portfolio or individual situation, or prove successful. Due to various factors including but not limited to changing market conditions and applicable laws, the content may no longer be reflective of current opinions or positions. You should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from SFG. Readers are encouraged to address this newsletter content and the applicability of any specific issue discussed above with a professional advisor of their choosing. SFG is neither a law firm, nor a certified public accounting firm, and no portion of the newsletter content should be construed as legal or accounting advice. Index returns are for illustrative purposes only and do not represent actual portfolio performance. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. The S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. A copy of SFG’s current written disclosure documents set forth on Form ADV Parts 2A, 2B, and Form CRS discussing our advisory services, fees and other important information. If you are an SFG client, please remember to contact SFG, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing, evaluating or revising our previous recommendations and services, or if you would like to impose, add, or modify any reasonable restrictions to our investment advisory services. Otherwise, SFG will continue to rely on the accuracy of information that you have provided and will continue to provide services based on the most recent pre-existing assumptions.