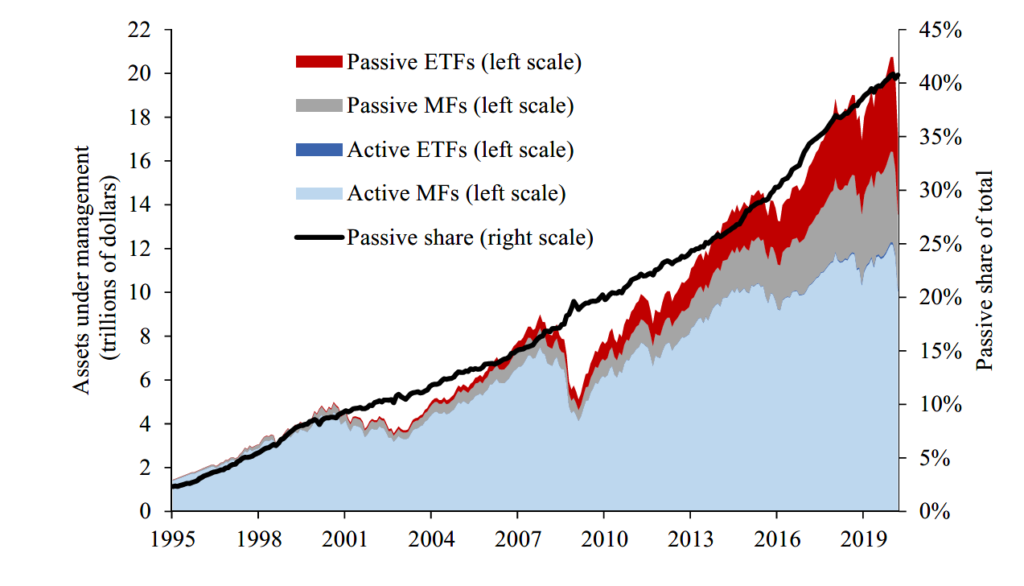

What’s the difference between active and passive investing? Why does SFG prefer active? We often hear these questions when discussing our investment managers and strategies with clients – and understandably so. As actively managed exchange-traded funds (ETFs) and mutual funds (MFs) have underperformed over the past decade, we’ve seen explosive growth in passive ETFs and a dramatic shift of assets into index-matching instruments (see chart below).

Total Assets in Active and Passive MFs and ETFs and Passive Share of Total

Favorable Environment for Active Managers

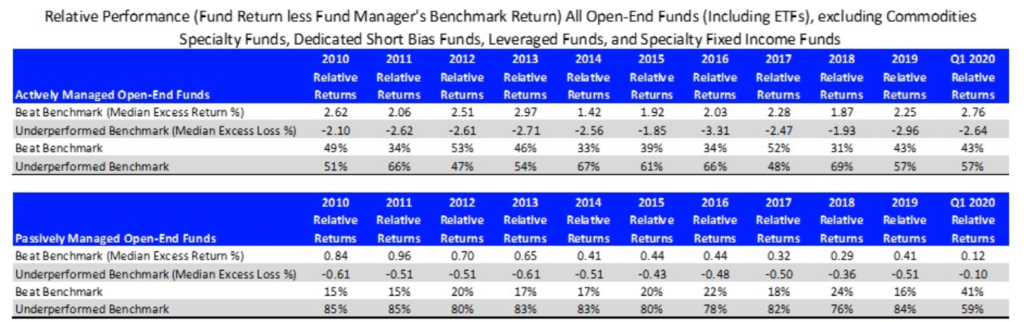

The active versus passive investing debate is not new. Over the past 10 years, a majority of actively managed funds have underperformed their respective benchmark (see chart below). We believe the current period of passive dominance has been mainly due to 10 years of dovish Monetary policy, which has helped extend the bull market beyond normal valuation metrics. In a market environment with low-interest rates, low volatility, and a narrow disparity between winners and losers, active managers are finding it difficult to add value. However, in a market with rising interest rates and increasing volatility, we believe the disparity between winners and losers will likely widen, creating a historically favorable environment for active managers.[i]

Actively Managed Funds vs. Respective Index

Source: https://lipperalpha.refinitiv.com/2020/05/the-debate-goes-on-active-vs-passive/

At the end of the day, active and passive funds move in cycles, with one typically outperforming the other at any given time since 1970. Therefore, it is prudent to have both in a diversified portfolio, depending on the investment strategy. The question then becomes, “what investment categories have historically performed best when actively managed versus their respective benchmark?”

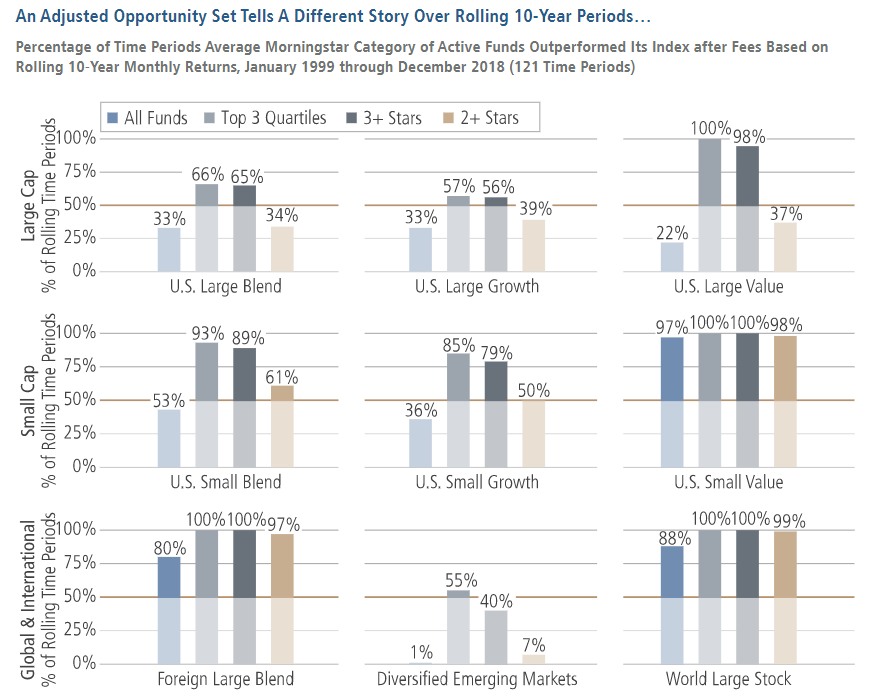

Our research found that the type of information used to compare actively managed funds to benchmarks can cause performance numbers to vary greatly over various time periods. For example, the chart below compares the top three quartiles of active funds versus their respective benchmarks over 10-year rolling periods from January 1999 through December 2018 (121 time periods). Only those managers in the top three performance quartiles were included because the bottom quartile of poorly performing funds was unlikely to attract significant investment flows.[ii] The results showed that the top 75% of “Active Managers outperformed their respective indexes after fees more than half the time in all nine categories, with managers in seven categories beating the index in at least 65% of the 121 measurement periods”.[i] This suggests that actively managed funds tend to outperform their respective indexes when analyzed over multiple market cycles. At SFG, we share this opinion.

Percent of Active Funds by Category Outperforming Its Index After Fees Over Rolling 10-Year Monthly Returns

Source: Neuberger Berman (citing Morningstar.) https://www.nb.com/en/global/insights/the-overlooked-persistence-of-active-outperformance

Our Approach to Managed Investing

An actively managed fund has the ability to make specific investments aimed at achieving specific goals, such as outperforming a benchmark, preserving capital, or managing risk.

Our approach is to identify and select active managers in each asset class who can execute specific investment strategies. To select managers who meet our criteria, we’ve dedicated ourselves to conducting due diligence, monitoring and vetting managers, and performing scenario analyses.

The managers we have chosen are not “closet indexers” who claim to be active but whose portfolios closely mirror their benchmarks. These active managers have demonstrated a disciplined process for selecting only securities that meet stringent criteria, such as a strong competitive position, growing intrinsic value, experienced management partners, and free cash flow. In addition, these managers may maintain cash reserves, meaning they can act as liquidity providers in the event of a market correction.

Conclusion

Investment managers may exercise various degrees of active or passive investing. Through our extensive due diligence process, Schultz Financial Group Inc. seeks to identify and recommend the highest quality active managers. Then, we build your portfolio with these managers, based on your goals and objectives. Finally, we continue to identify, monitor, and evaluate managers according to our investment philosophy.

Interested in more information related to investment management? Click here or contact us at 775-850-5620.

Schultz Financial Group Inc. (SFG) is a wealth management firm located in Reno, NV. Our approach to wealth management is different from many other wealth managers, financial advisors, and financial planners. Our team of fee-only fiduciaries strives to help our clients build their wealth across four capitals: Financial Matters, Physical Well-being, Psychological Space, and Intellectual Engagement. We provide family office and wealth management services to clients located in Nevada, California, and other states. If you’d like more information, please check out our website or reach out to us via our contact page.

[i] https://documents.nuveen.com/Documents/Nuveen/Default.aspx?uniqueId=4D667B95-D0BE-44B2-843A-A13831FD5E7B&subid=7%7C2%7C3%7C4%7C5%7C6

[ii] Amato, J. V., D’Onofrio, P., & Rago, A. (2019, March). The Overlooked Persistence of Active Outperformance. https://www.nb.com/documents/public/global/s0192_active_vs_passive_wp.pdf.