Monitoring Inflation and Inflation Expectations (Phillips Curve)

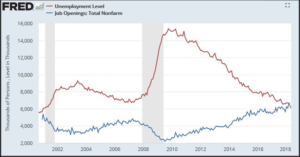

For the first time since the data collection began in 2002, there are more job openings in the US than there are people unemployed (see chart below). We are currently in the second-longest economic expansion in our history, and if it continues through July 2019, it will become the longest. This has led to a period of prolonged job creation, which has driven down the unemployment level below four percent.

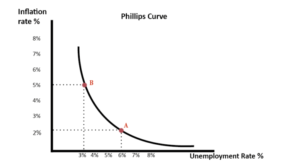

With all of this job creation and low unemployment, economists are scratching their heads trying to figure out why we are not seeing inflation. The Phillips curve (shown below) is a simple graph that describes the inverse relationship between unemployment and inflation. Simply put, as the unemployment level goes down, inflation begins to rise. This is fairly intuitive. For example, during the financial crisis, many people lost their jobs. This caused a shortage in demand for goods and services, which resulted in an aggregate price drop (deflation) for those goods and services. This is calculated as the Consumer Price Index (CPI), which is published monthly by the United States department of labor.

Continuing with our previous example but placed in today’s economic environment, the reverse should be true. According to the Philips curve, with less than four percent unemployment, we should be seeing strong inflation numbers. However, we are not. The main reason this could be happening is that technology is inherently deflationary.

Think about how many products your smartphone alone has replaced — cameras, mp3 players, calculators, GPS navigation, flashlights, calendars, etc. Now, think back to your entertainment center in the early 2000’s. Today, smart TVs need only a power connection to provide the entire internet of entertainment through streaming. This exemplifies a strong rise in quality over the years while incurring a steady decline in prices.

Inflation is expected to pick up soon, which is one reason why the federal reserve has raised rates twice already this year, and is expected to do so two more times in 2018. Inflation may begin to shine as the effects of the tax cuts and deficit spending are in full swing right now, stimulating strong economic growth such as the 4.1 percent we experienced in the second quarter of 2018. As this situation continues to develop, SFG will continue to monitor and assess its risk when conducting our investment selection process.

Important Disclosure Information: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Schultz Financial Group Incorporated. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Schultz Financial Group Incorporated is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Schultz Financial Group Incorporated’s current written disclosure statement discussing our advisory services and fees is available for review upon request. Please Note: Schultz Financial Group Incorporated does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Schultz Financial Group Incorporated’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Design by Jason Design Studio | Design by Refresh Design Services | Copyright © 2018 Schultz Financial Group Inc.

Design by Jason Design Studio

Design by Refresh Design Services

Copyright © 2018 Schultz Financial Group Inc.