Tax Cuts and Jobs Act: an Overview

The Tax Cuts and Jobs Act was approved by Congress and signed by President Trump in late December 2017. The Tax Cuts and Jobs Act features the most changes to the U.S. tax code in decades and it will impact nearly every individual and business. The SFG Financial Planning team is researching how these changes will impact our clients. Most of the provisions discussed in this article are active for tax years 2018 through 2025. Below is our summary of the how Tax Cuts and Jobs Act will affect individuals:

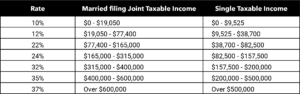

Tax Rates

- The new tax rates are as follows: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

- There is no change to the current tax treatment of qualified dividends and capital gains.

- There is no change to the net investment income tax (NIIT).

- The Affordable Care Act was left largely untouched with one exception: the repeal of the individual shared responsibility requirement. Taxpayers will no longer be required to pay a tax penalty for choosing to go uninsured.

Deductions & Credits

- The standard deduction was raised to $24,000 for married individuals filing a joint return, $18,000 for head-of-household filers, and $12,000 for all other individuals.

- A higher standard deduction will simplify tax returns for many filers by reducing the need to itemize deductions.

- The mortgage interest deduction is limited to the interest paid on a mortgage with principal loan value up to $750,000 if married filing joint and $500,000 if single.

- Homeowners may keep the current limitation of $1 million if they incurred their loan before December 15, 2017.

- No interest deduction is allowed for home equity loans.

- State and local tax deductions are limited to $10,000 for married filing joint and $5,000 for single filers. This includes property taxes.

- Miscellaneous itemized deductions above 2% of adjusted gross income (AGI) are no longer allowed.

- The medical expense deduction can be taken if expenses exceed 7.5% of AGI for 2017 and 2018.

- The child tax credit was increased to $2,000 per qualifying child, and up to $1,400 of that amount is refundable.

- 529 college savings plans can now be used to fund up to $10,000 of education expenses for public, private, and religious elementary or secondary schools.

- The student loan interest deduction remains.

- For divorces or separations executed after December 31, 2018, alimony payments will not be deductible or reported as income.

- The estate and gift tax exclusion was doubled to $11 million per individual, $22 million for married couples.

- The annual gift tax exclusion was raised to $15,000 from $14,000 per individual.

For more information on the Tax Cuts and Jobs Act, read our other blogs about it:

Important Disclosure Information: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Schultz Financial Group Incorporated. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Schultz Financial Group Incorporated is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Schultz Financial Group Incorporated’s current written disclosure statement discussing our advisory services and fees is available for review upon request. Please Note: Schultz Financial Group Incorporated does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Schultz Financial Group Incorporated’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Design by Jason Design Studio | Design by Refresh Design Services | Copyright © 2018 Schultz Financial Group Inc.

Design by Jason Design Studio

Design by Refresh Design Services

Copyright © 2018 Schultz Financial Group Inc.