The Risk of Pension Liabilities

What is Pension Risk?

One of the macroeconomic areas of risk to the economy is public and private pension liabilities. The former also has an effect on the municipal bond market. The risk to the public and private pension system is underfunding. This happens when a pension fund has liabilities on its balance sheet which outweigh its assets. This occurs when the actuarial assumptions for inputs like investment returns are too high, future contributions are too low, life expectancy is underestimated, etc.

Example: CalPERS

Consider CalPERS the nation’s largest defined benefit pension fund, which carries $326 billion in assets as of June 30th 2017 and a $477 billion liability making it 68.3% funded for FY 2015/2016 (PERF). This means CalPERS has a deficit of approximately $151 billion. These are ways this issue can be resolved:

1. CalPERS increases contribution requirements on municipalities.

2. Future investment returns are enough to make up the variance.

3. Operating expenses of the fund continue to be cut.

4. Benefits are reduced.

CalPERS’s increase in contribution requirements is sustainable in the short run but might not be sustainable in the long term. If CalPERS continues to increase its contribution demands, CA municipalities may be forced to cut services like law enforcement, road repairs and education in order to make the payments or file bankruptcy like the City of San Bernardino and Stockton did in 2012 which impacted their municipal bonds.

Public Pension Liability Risk

Public pensions on average assume 7.75%* return on investments. This assumption also has the effect of making CalPERS’s liability look smaller than it would be if a lesser rate of return were used. To this point, Stanford’s California Pension Tracker estimates CalPERS liability would be a $992.4 billion if a rate of return of 3.25% were used.

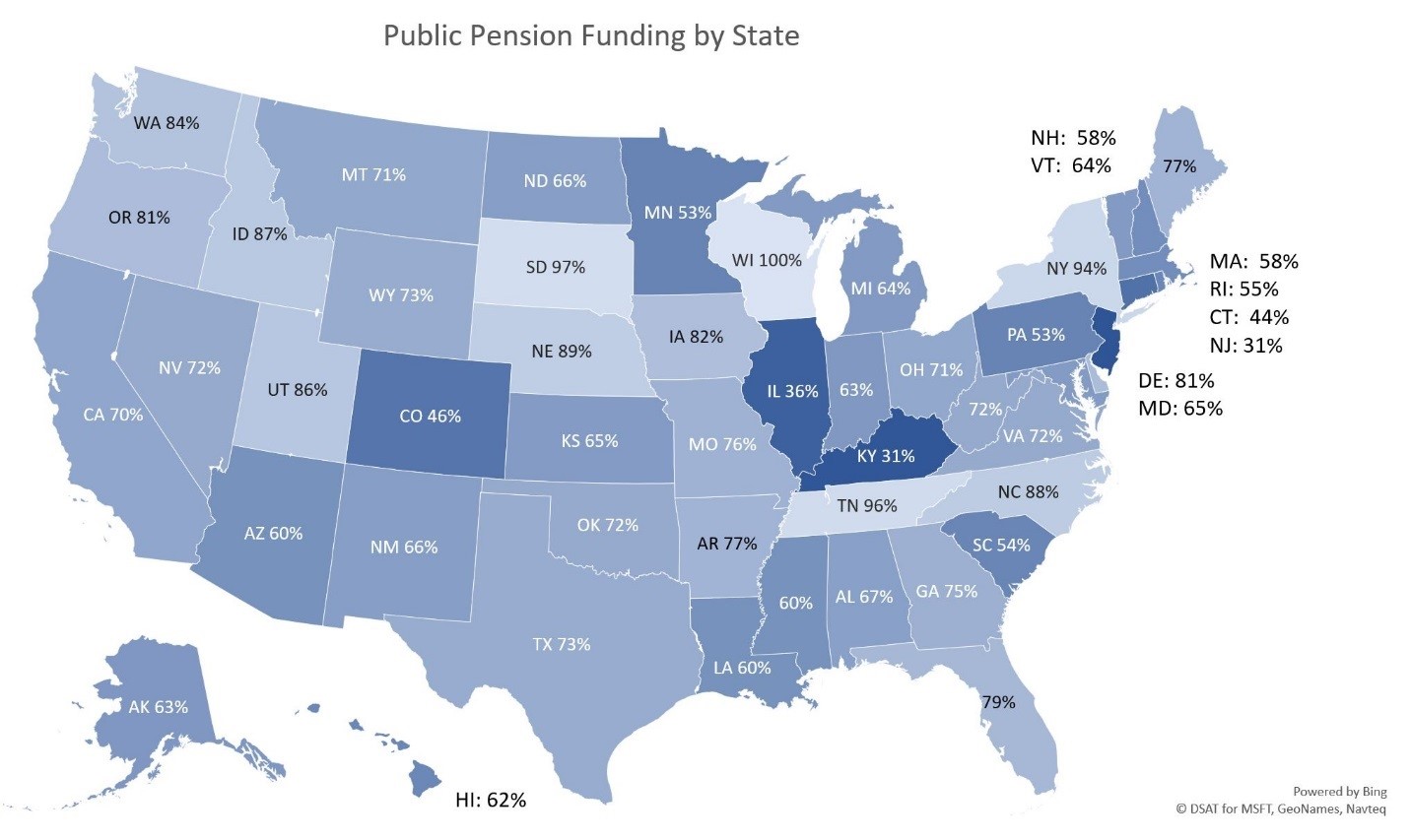

Though CalPERS alone represents a risk, how are other states faring in terms of funding?

Some states appear to be handling their pensions responsibly, however, residents of states such as Illinois, Kentucky, New Jersey and Colorado should be worried about the longevity of their retirement funds. Collectively, the public pension deficit across the United States, according to publicly available 2016 data, amounts to $1,393,400,000,000. And that assumes a 7.75% average rate of return. Any return less than 7.75% and that liability grows.

Private Pension Liability Risk

As for private pension plans, an article from Bloomberg titled “S&P 500’s Biggest Pension Plans Face $382 Billion Funding Gap” By Brandon Kochkodin and Laurie Meisler dated July 20, 2017 said “People who rely on their company pension plans to fund their retirement may be in for a shock: Of the 200 biggest defined-benefit plans in the S&P 500 based on assets, 186 aren’t fully funded. Simply put, they don’t have enough money to fund current and future retirees. The situation worsened for more than half of these funds from fiscal 2015 to 2016. A big part of the reason is the poor returns they got from their assets in the super low interest-rate environment that followed the financial crisis. It’s left a hole of $382 billion for the top 200 plans.”

Pension Benefit Guarantee Corp

In addition the Pension Benefit Guarantee Corp (PBGC), a non-profit corporation that functions under the jurisdiction of the Department of Labor, that guarantees the payment of certain pension benefits under private defined-benefit plans that have been terminated with insufficient money to pay benefits, is underfunded. The Pension Benefit Guaranty Corporation FY 2016 Annual Report stated “Multiemployer defined benefit plans provide retirement security to more than 10 million participants and their beneficiaries. But PBGC estimates that plans covering about 10% to 15% of the 10 million multiemployer participants are at risk of running out of money over the next 20 years and that PBGC’s multiemployer insurance program is likely to run out of money by the end of 2025. Insolvency of PBGC’s multiemployer insurance program would devastate not only the retirement benefits of the 1 million to 1.5 million participants and their families in these at-risk plans but all the participants in multiemployer plans that are currently receiving financial assistance from PBGC as well.”

Conclusion

The above information is why we at SFG look at Public and Private Pension Underfunding as one element of the debt risk to the economy. We believe one possible scenario to the next economic downturn will be connected to some form of debt, just as mortgage loans were to the over-leveraged system in 2008-2009.

*CalPERS announced in December 2016 their intention to incrementally reduce their assumed discount rate to 7% by 2020.

For additional information, please see this Bloomberg article on Fees Rise for Underfunded Pensions.

Important Disclosure Information: The information contained within this blog is for informational purposes only and is not intended to provide specific advice or recommendations. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Schultz Financial Group Incorporated), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Schultz Financial Group Incorporated. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Schultz Financial Group Incorporated is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Schultz Financial Group Incorporated’s current written disclosure statement discussing our advisory services and fees is available for review upon request. Please Note: Schultz Financial Group Incorporated does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Schultz Financial Group Incorporated’s web site or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Where you want to go in life is up to you. How to help you get there is up to us.

Contact us today to start your journey…

Contact

Schultz Financial Group Inc.

10765 Double R Blvd. Suite 200

Reno, NV 89521

Phone: (775) 850-5620

Fax: (775) 850-5639

Email: [email protected]

Design by Jason Design Studio | Design by Refresh Design Services | Copyright © 2018 Schultz Financial Group Inc.

Design by Jason Design Studio

Design by Refresh Design Services

Copyright © 2018 Schultz Financial Group Inc.